The perceptions of how the stock market and finance should operate are coming into the third season. In times past, you had a trading floor and ticker tape. Recently, the trading floor and ticker tape were replaced by computerized trades, operating on the level of milliseconds. Now we have the Mirror Protocol token. This is a new trading update that allows the stock market and other financial instruments to take on the new and exciting territory.

A new plan of action using decentralized blockchain technology

Cryptocurrency in general has been an eye-opening endeavor for those who think about money. Trustless systems are now in place and protected by encryption to keep them safe. Hence the name “crypto” currency. The blockchain is the digital ledger for digital currencies like bitcoin. The list of all transactions is safely kept by being encrypted in the computers of thousands of bitcoin users. But the public ledger is kept online for all to see.

The Mirror Protocol token (MIR) uses this trustless system as well. While the bitcoin blockchain is simply called “the blockchain” the Mirror Protocol token operates on the Terra blockchain. This flexible blockchain is not located in one place but is also decentralized. That is, it is distributed on the computers of those around the world. The Terra blockchain is powered by a proof of stake model not a proof of work system like the traditional bitcoin blockchain. This allows those who have converted other crypto coins or fiat money into the MIR arrangement to have a voice. It also allows those who have bought into it to have a passive income source.

The history behind the MIR token

Terraform Labs is the driving force behind the creation of this token. They started in South Korea under the guidance of Do Kwon and Daniel Shin. According to Mister Shin, the idea was not to replace payment systems but to augment them. The goal was to offer a payment system similar to Stripe. The whitepaper that was released stated that this token was created as a “stable” coin. It is a cryptocurrency that would not wildly go up and down in price. It was pegged to the US dollar. Asia was the target region because it is the most popular part of the world using cryptocurrencies. The natural competitor to this token is the Alipay payment system used by Alibaba.

The advantage is that the MIR token is designed from the beginning to be decentralized, while Alipay is not and may never be decentralized. The token was designed to be stabilized by a twin stable coin called Luna which acts as a deterrent to inflation or deflation of the MIR token. The word “luna” in Spanish is “moon” and this is the goal of the crypto Luna. It provides stability to the MIR token like the Moon provides stability to the Earth.

Also Read: Central Bank Digital Currency (CBDC)

Ways to understand the usage of the Mirror Protocol

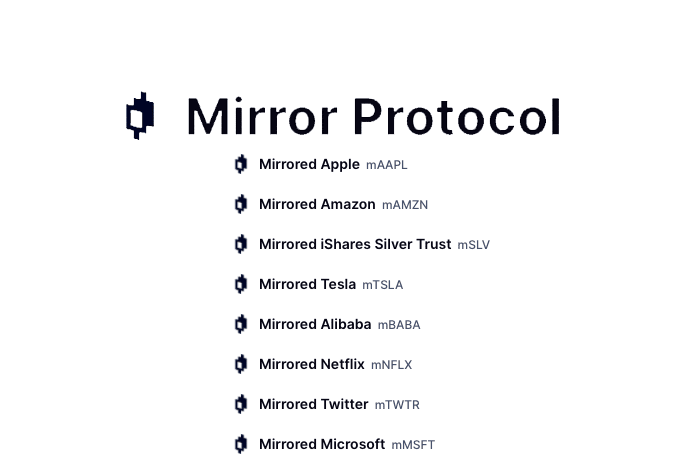

As the name implies, the mirroring aspect of the MIR token is to replicate digitally what is already happening in the regular world. For example, if you want to start trading a stock there are at least two ways to do so. It is possible to get an account with Binance and start trading stocks on their trading platform using the MIR token. This is a way to get into the more popular stocks immediately. Using MIR provides special advantages over using Wall Street. An investor can buy a percentage of stock. This allows more expensive stocks to come into the range of those who have less money to spend on trading.

Another advantage is that this token opens up the stocks to global trading. The Mirror Protocol does not require a person to be a United States citizen to be able to trade a Tesla or Chevrolet stock. The Yuan currency can be traded without having to become a Chinese citizen. Anyone can participate and start trading from around the world without regard to nationality or location. Just as smart contracts have been negating the need for some lawyer’s services, the Mirror Protocol will likely begin decreasing the need for professional trading services.

MIR creates synthetic assets

There is rubber and there is synthetic rubber. Similarly, there are “real world” assets and there are synthetic assets. A physical asset like gold or silver could be thought of as a “real world” asset. But now the MIR token can be assigned to gold.

Let’s say an ounce of gold has a value of $1904. A MIR token user can assign a value to that same ounce of gold. The token now has become a synthetic gold asset and reflects the value of an ounce of gold on the Terra blockchain. This is also called a mAsset. This stands for “mirrored asset”. If you are familiar with the online virtual world called Second Life, the MIR token is doing the same thing in the financial world. It is now possible to pick something with value and give it a mAsset value with the MIR token.

One point to remember is that the synthetic ounce of gold can be traded globally without regard to current regulations. Also, a fraction of the ounce can be traded digitally because the MIR token allows this. This is true about any asset. Any real-world asset or item can become a mAsset using this system.

A comprehensive blockchain for today and tomorrow

The inherent design in the Mirror Token allows for more development potential. It incorporates the ability to make a new market instantly. It integrates with other coins such as Ethereum and the Binance Smart Chain network. Because of this any trading profits can be sent to these other assets quickly and be cashed out. All companies large or small can be mirrored. Some of those from today are Apple, Tesla, Microsoft, Airbnb, GameStop, and even Goldman Sachs. Any company that is created in the future will be able to be traded as well. Bitcoin and fractions of bitcoin can be synthetically mirrored and traded. This token is like a monster that devours everything in its path. If any new financial instrument or product should come into being in the future it will be able to be tokenized immediately and freely by anyone in the world.

The benefits of the decentralization of the stock market

A new and improved method has begun with the creation of the Terra blockchain and the MIR and Luna tokens. It may not be next year, or even in five years, but the decentralization of the web and its related components has already started. When something as universally established as stock markets have now been reinvented with just some programming, it is more than likely going to be a windfall for those who have felt shut out. There are large benefits to this process. Corruption and market manipulation can be lessened. The complicated procedures for getting a stock listed and for “going public” will be coming to an end.

How will the changeover happen to this new financial upgrade?

Everything that has a beginning also has an end. It will happen like the horse and buggy were replaced by the automobile. During its inception, the automobile had to use roads that were nearly all mud when it rained. The autos broke down a lot and many times horses were scared of them. Then, infrastructure started to be made to accommodate automobiles. Paved roads and gas stations and then highways started to be made. At some point, a flip happened and the general public started to use automobiles more than horses.

This is how it will be when the “horse and buggy” stock market of today is replaced by a streamlined, trustless, decentralized digital stock market. Humanity will have taken the logical next step to get rid of the middle man and using that profit for themselves. When that happens, true progress will have happened in the financial world.