A Central Bank Digital Currency (CBDC) is an asset issued by a central bank in a wholesale financial market. The goal of the CBDC is to provide digital access to as little physical currency as possible. The idea is that banks will be able to issue and trade digital cash on the network in which they operate, without the need to have physically stored cash or to facilitate cash handling. In theory, this would eliminate costly banking infrastructure and reduce money laundering and counterfeiting rates in countries with very inefficient financial systems. This article will give you a basic understanding of what Central Digital Currency is, how it came to be, different uses, advantages, disadvantages, countries already testing CBDC and the future of digital currency.

1. What is Central Bank Digital Currency (CDBC)

Central Bank Digital Currency is a type of digital currency issued by central banks. It uses distributed ledger technology similar to cryptocurrencies such as Bitcoin. However, CDBC differs from cryptocurrencies in its design and purpose. In CDBC, central banks have full control over the entire monetary system, and the transactions that take place are traceable and transparent. The issuance of additional tokens is also closely monitored by the central banks. The goal of CDBC is to facilitate transactions and make them easier for users.

The idea of CBDC

The idea behind Central Bank Digital Currency is simple and straightforward. Since the central bank is in charge of the entire monetary system, it can monitor these transactions and keep them transparent. The obvious advantage is the lower cost of operations, which means the central bank doesn’t have to mint physical currency. The central bank can also issue more tokens in the market whenever it wants.

Advanced and Dissimilar Design

Unlike other cryptocurrencies, CDBC is not designed to be a currency. However, they are somewhat similar to e-money in the sense that they facilitate transactions and units of accounts. Another similarity between CDBC and e-money is that both are scalable, as both use Distributed Ledger Technology (DLT). DLT can scale tokens without depending on the number of individual computers supporting the network.

Technology behind CBDC

The technology behind CBDC is similar to that used by cryptocurrency networks like Bitcoin. However, the difference lies in how the tokens are issued. Central banks have full control over the monetary system and how they issue money. Essentially, this is a form of digital fiat currency. The central bank will use distributed ledger technology to keep transactions transparent and traceable. CBDC also uses DLT to keep transaction records immutable and decentralized. This technology is also used in other forms of currency such as Ripple (XRP).

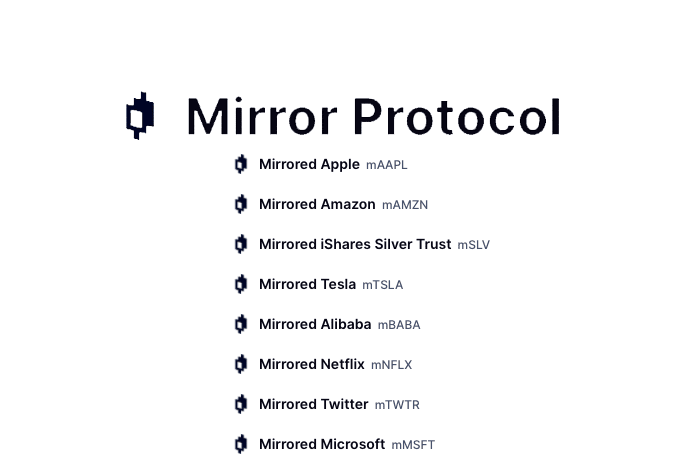

Also Read: Mirror Protocol ($MIR) Token

2. How is Central Bank Digital Currency different from cryptocurrencies?

While central bank digital currency and cryptocurrencies are both based on blockchain technology, their design and purpose are different. Cryptocurrencies rely on decentralization to function, while CDBC is controlled by the central bank. CDBC is a traditional form of money that is digitized by using distributed ledger technology to record these transactions. Distributed ledger technology is transforming various industries, including banking and finance. The first use of blockchain in the banking sector was introduced by Commonwealth Bank (CBA) and Westpac Banking Corporation (WBC) in November 2015. The Blockchain implemented by CBA and WBC is to streamline their international money transfer services. However, CDBC is not yet used by any bank in the US or Europe.

Another important difference between CDBC and cryptocurrencies is that CDBC cannot be mined like Bitcoin and other cryptocurrencies. Cryptocurrencies are mined by adding blocks to a blockchain using complex cryptography. Unlike blockchains, CDBC is controlled by the central bank. In China, for example, the PBOC and commercial banks have formed a consortium to partner to explore ways to further digitize the Chinese currency.

3. Different Uses for CBDCs – savings, transactions, transfers, etc.

- CBDCs can be used for recording transactions.

- This enables the central bank to track these transactions in real-time and monitor the flow of funds. Such information is important to prevent financial crimes like terrorism, money laundering, tax evasion and smuggling. There has also been a boost in the transparency of the measures taken. For example, the central bank can tell people when they can expect interest rate hikes and other announcements. This happened in 2015 when the Bank of England started using blockchain to publish public statements and report on new developments.

- The Central Bank’s Digital Currency can also be used to store money in a digital format. This type of digital savings allows customers to store their money into bank accounts without having physical access to it (mobile phones are used for this purpose). In return, they receive a digital reward for holding these savings at regular intervals. This is similar to a retirement savings program that exists in the US. CBDC would be ideal for such programs where customers are unable to hold paper money for an extended period.

- CBDC will also be used for money transfer services. For example, customers will be able to transfer their digital cash to other banks across the country using their phones. This service will reduce the cost and allow quick transfer of money between banks. In addition, this type of method will reduce physical money by allowing digital access to the least amount of physical currency possible. The idea is that banks will be able to issue and trade digital cash on the network in which they operate, without the need to have physically stored money or facilitate the handling of cash.

4. Disadvantages of CBDCs – security, risk, efficiency, etc.

As mentioned above, there are many advantages to using CBDCs. Nevertheless, one must also be aware of the disadvantages. The disadvantages include the following:

Security

As mentioned earlier, CBDC is controlled by the central bank. This means that a centralized system can be vulnerable to hacking attacks that target the bank or the system. There will also be a lack of transparency and accountability for these transactions as they are not recorded in an open ledger like Bitcoin (which uses blockchain technology).

A lack of liquidity

CBDCs are not decentralized and do not allow others to independently confirm these transactions. This leads to transaction restrictions (like a credit card). Banks must be able to manually confirm transactions. This limits how much cash you can withdraw from the bank.

Transaction fees and exchange rates

Since CBDCs are not decentralized, this means that they will only be available at banks. This will increase the cost of using these digital currency systems compared to other crypto assets. In addition, they will also be vulnerable to inflation as the central bank has to leverage over their circulation.

Legal issues

Legal issues may arise due to the fact that central banks do not have full control over CBDCs. Central banks will create a legal framework and regulations for CBDCs as they have done for the current financial system. However, the legal status of Bitcoin and other cryptocurrencies is still up in the air. Should these digital currencies fall under the same regulatory regime as bank-issued currencies, or should they remain unregulated?

Efficiency

Since CBDC transactions would be processed through a centralized bank, the process could be slower and inefficient. The time it takes a person to complete transactions with their CBDC may not be as fast as with cash or even their debit card. In addition, the fact that a CBDC is used in conjunction with an existing currency can also create efficiency issues. The user will need to use their existing currencyies to convert them to CBDCs and vice versa if they want to convert them back.

5. Countries already testing or implementing the concept

Currently, there are only a handful of countries using CBDCs. However, many countries have talked about implementing this concept.

Sweden

In 2018, the Riksbank – Sweden’s central bank – announced a project that would provide a “cashless” option for payments. The concept behind this idea is to create a digital currency that could be used by banks for interbank payments instead of using cash. This project could create a cashless society in Sweden.

China

In July 2018, the People’s Bank of China, the country’s central bank, released a document officially stating that virtual currencies like Bitcoin are not legal tender and are not used by government agencies. Nonetheless, they stated that local governments are allowed to use CBDC to conduct transactions and that CBDC would be kept domestically in each region. The central bank also said it would conduct more research on the concept.

France

The Bank of France started a pilot program for CBDC in 2020. It is expected that the program will expand to all financial institutions soon. This pilot program will help determine the best way to design and implement a CBDC.

The Philippines

In June of 2018, the American-based blockchain research firm ConsenSys announced a partnership with the Central Bank of The Philippines to create a digital fiat currency in The Philippines. This is one of the only instances where a central bank will join forces with an outside company to create CBDC. They are testing a CBDC that will be used for interbank payments. If all goes well, the BSP plans to move towards a cashless society.

Japan

In April of 2021, Japan announced that they would be introducing a text trio of CBDC to see how it works with the Yen. This has been one of the largest nationwide implementations of CBDC yet.

Turkey

Turkey’s central bank is also testing a CBDC that is meant to be used for interbank payments. This trial CBDC will be a domestic product, but the central bank expressed interest in future trials that can take place internationally.

Switzerland

In 2020, Switzerland announced a new CBDC venture called, Project Helvetia. Project Helvetia is a study of the feasibility of integrating tokenized assets and central bank money. This CBDC will be used to conduct interbank and retail payments.

6. Future Of Central Bank Digital Currencies

The future of CentralBank Digital Currencies is bright, they will revolutionize the financial industry by bringing more efficiency and transparency to all. The issuance of CBDC will increase in the future as more and more banks work on it and implement it through their systems. The goal of banks is to offer a new way of banking that allows them flexibility and easier transactions while keeping the monetary system stable. This is just the beginning of that revolution. It will be big. But it may be some time before it becomes a widespread and accepted method of currency in the global financial market. Future developments of Central Bank Digital Currencies will be planned, regulated and overseen by the central banks themselves, rather than the commercial banks with which they have relationships. This would give Central Bank Digital Currency more transparency and protection than other digital assets. The following things will happen in the future:

- Central Banks will have to compete with each other for lower interest rates and do more than just lower their prime rates. They may also introduce CBDCs or introduce negative interest rates on bank deposits.

- Central Banks will have better control over the money supply because they will be able to increase or decrease the number of tokens they issue as needed. – Central Banks will increase their control over asset prices and with the help of CBDCs they will be able to set a floor price for these assets.

- Central Banks may also set up a system of dividends or interest-free loans via CBDCs to their domestic banks.

- Central banks will always have control over the system that creates CBDCs, especially if they are issued by themselves. This means that no cryptocurrencies like Bitcoin can create their own central bank digital currency.

- Central Banking digital currency does not take time, digital transactions become faster as the system is very efficient. In addition, the fees can be reduced to zero.

In conclusion, Central Bank Digital Currencies will make the financial system more stable, efficient and transparent. The future of CBDCs is bright. Reading this article should have given you more insight on what they are and how they will change your world, as well as the world at large. Central Bank Digital Currency (CBDC) has the potential to improve many aspects of the current financial system. CBDC will be more efficient. Transactions will be simpler and faster. CBDC will be more secure because the central bank has full control over the system. In addition, CBDCs can help central banks to avoid financial crises like those of 2008 and 2009, as they can use their CBDCs to expand their balance sheets by creating new money, while also paying a negative interest rate to paper currency holders.