In the latest development concerning the 2018 fraudulent case of US global crypto platform Bitconnect, the Securities and Exchange Commission of New York will be suing five people for their alleged involvement in the fiasco.

In 2018, the global crypto platform Bitconnect was asked to shut a workshop after the US Securities and Exchange Commission found out that the crypto platform had engaged a network of promoters to sell securities to the tune of $2 billion without permission from the SEC. Acting upon an SEC complaint state regulators in Texas and North Carolina filed ceased and desist notifications against the company leading to a complete collapse of Bitconnect.

Bitconnect conducted trading of securities without permission

Now after two years of investigation, the SEC on Friday the 28th May 2021 has filed charges and will be suing five people for their alleged involvement in the fiasco. According to the complaint filed by the SEC which was first filed in the United States District Court for the Southern District of New York, between 2017 to 2018, besides not obtaining permission from the SEC, Bitconnect did not register the platform as a broker and dealer, a rule under federal securities law.

Speaking on behalf of the New York SEC, Associate Regional Director Lara Shalov Mehraban, stated: “We allege that these defendants unlawfully sold unregistered digital asset securities by actively promoting the Bitconnect lending program to retail investors.” “We will seek to hold accountable those who illegally profit by capitalizing on the public’s interest in digital assets.” She added.

Also Read: How Does Cryptocurrency Gain Value?

Five individuals named in the suit

The five in question charged by the SEC are promoters of the platform including U.S.-based Trevon Brown of Myrtle Beach, Craig Grant, Ryan Maasen, Michael Noble and Joshua Jeppesen who is charged with encouraging and assisting the sale of securities by Bitconnect. The modus operandi of the promoters involved soliciting and luring prospective investors by extolling the lucrative benefits of investing in a lending program initiated by Bitconnect. The strategy included using YouTube videos that showed positive and favorable testimonies by others as mentioned by the SEC. The SEC also mentioned that the promoters had received large commissions when successfully acquiring funds from investors.

SEC is seeking the following actions

In its lawsuit against Bitconnect, the SEC is seeking a complete halt of the defendant’s financial activities in a manner of injunctive relief and the return of the money the defendants made. The suit also demands the five to pay civil monetary penalties.

Since the scam, Bitconnect was under FBI surveillance and was being investigated by the federal body for the last three years. In 2019, federal investigators have issued notices for investors to reach out, however, no criminal complaints had been filed as yet. However, following the filing of the suit, criminal charges were yet to be placed upon the five defendants in question.

Bitconnect officials from India and Australia already arrested

Promoters of the $2billion Bitconnect Ponzi around the world are also facing penal action. Divyesh Darji, the head of Bitconnect India was arrested in 2018 on charges of scamming Rs 88, crore ($12 million) by capitalizing on investors trying to find financial respite during India’s demonetization program. The national promoter of Bitconnect Australia was arrested on grounds of operating an unregistered managed investment scheme that invites a jail term of 5 years and/or a fine of $42,000.

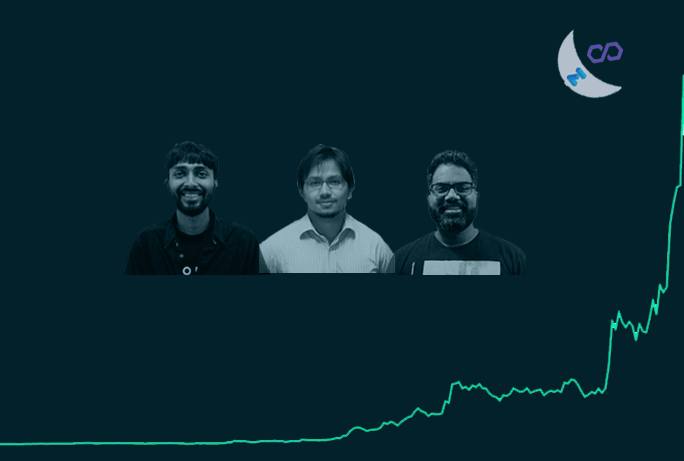

The Bitconnect investigation is being supervised by John O. Enright, Ms. Lara Shalov Mehraban, and Kristina Littman, Chief of the Cyber Unit.