Yield farming and liquidity mining are new enough topics that just a few people have heard of them. They are an excellent part of the world of cryptocurrency that should not be ignored. Just like in the world of fiat money now there are ways to put your own cryptocurrencies to work for you. In present-day financial terms, this would be called an investment.

What is yield farming?

The most basic definition of this term is the act of using crypto to get a higher return. The word “farming” gives the idea of getting back a crop. For example, if you are a yield farmer, you would be searching for the best coin or token that you could buy that provides a better interest rate. You may leave Polkadot and go to TerraUSD. Whichever coin you think will make the best money, in the end, would be your choice. Just as a regular farmer who grows corn may want to switch to wheat or strawberries to get a better yield from his land, the same applies in the world of crypto for this term.

What is liquidity mining?

In today’s new decentralized financial system, liquidity mining is similar to yield farming. The difference is in the act of distributing extra tokens to the users of a protocol. Those who do this are called liquidity providers. For those who are using cryptocurrency exchanges, the yield farmers will be a prominent group of these providers. One part of this process is to use a liquidity pool to lend to others who want to make money as well. When tokens are traded in the pool those who provided those tokens will earn a fee. Other people will also be using the crypto to make money and will get a cut of the profits. Another name for a liquidity pool is “smart contract”. All it takes is to perform certain actions that are contained in the smart contract or liquidity pool and a person becomes a part of liquidity mining.

Also Read: Terra Blockchain

Yield farming is trending

Just like in many forms of new technology, the early adopters are usually the ones who have the most success. The innovation has already taken place in the form of decentralized cryptocurrencies and finance. Now it is time to put that knowledge and system to work for us. The utility of yield farming is bringing fruit and so people are starting to take notice. For instance, in August and September of last year, a huge spike in interest started for those who are learning about yield farming. Ever since then there has been a major upward trend of interest in this. Why? It simply works. People are learning the basics and then going on to be successful in decentralized finance using these methods.

What problems does yield farming fix?

There are basic problems with the current centralized finance system. They have a system using fiat money that usually loses its value over time. The resulting inflation causes the users of fiat money to pay more and more for everyday items. If a person wants to get a loan in the centralized system, they will have success based on some personal details. Some of those details maybe their credit score, their friendships, and even their skin color.

What is insidious about the credit score detail is that the same bankers also control that part of their finance system. These problems are eliminated in the world of decentralized finance. There is no banker that needs to be pleased. All transactions in the yield farming process are taken care of by users, machines, and smart contracts. They are impersonal and no credit score is needed. The blockchain is decentralized finance that does not care about a users’ skin color or friendships. It is just a machine based on math. The last and most potent problem that yields farming fixes are the lack of percent of interest. Those who try to get a savings account in the traditional centralized system of finance will get a typical 3% in a best-case scenario. This is low compared to those who are farming crypto.

How does yield farming mining work?

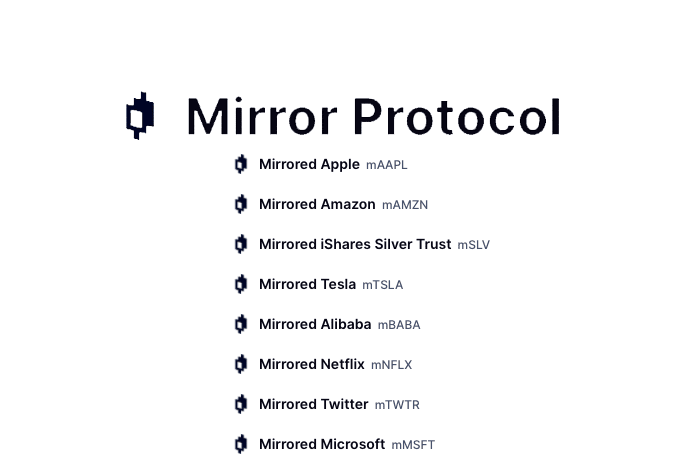

Let’s use a hypothetical example of a person that is interested in some of the stablecoins that are currently offered in crypto. One is Tether, another would be TerraUSD. This investor is a person that is heavily invested in Tether. But they are open to other opportunities. Being a yield farmers, they start looking at the trends in the world and decide that they would get a better return on their money with TerraUSD. TerraUSD includes the Anchor Protocol, which is a lending platform built by the same company that created TerraUSD. Taking the 1:1 ratio of Tether to the US dollar, the person in our example trades their Tether for TerraUSD.

Why would they do this?

There are zero returns in rewards apart from the staking (owning a coin) aspect when using Tether. No interest is offered with their coin even though staking in and of itself is an investment and produces a return with Tether. They then start receiving around 18 to 19 percent returns (profits) using the Anchor Protocol. No staking is required. It is just like the older days of having a savings account with a bank. The huge difference is that the interest rate easily beats any bank in the world.

The act of using the interest rates of different stablecoins to make a profit is similar to what goes on in staking coins and yield farming mining. But Tether does not offer this. So it all depends on the numbers. If one particular stablecoin can be loaned at a rate of nine percent while another coin gives a savings deposit return of 18 percent, it makes sense to receive the loans of the first stablecoin and invest it into the second coin. Simple math tells us that those who do this will get an unbelievable 100 percent return on their money if they can find such a deal anywhere. The good news is that this is found online in the world of decentralized finance.

How are yield farming returns calculated?

Just like the physical farmers who farm corn and wheat, yield farming is rated based on its returns. Something called the “Annual Percentage Yield” or APY, is used to determine if a coin or token has maximum yield for its farmer. This term means the total profit for twelve months of operations. Another way to say it is the annual performance vector. The higher the number the better. Depositing $200 in the Anchor Protocol would net a user around a $36 profit if the account was left to mature for the entire year. This is at the present interest rate of 18 to 19 percent.

Risks of yield farming

The basic risk of yield farming is financial and computer ignorance

The new users who use centralized exchanges to try to be yield farmers are much more likely to lose their money when someone hacks the website of the exchange. Using decentralized exchanges can help to prevent this. Binance is one such exchange. Another risk is unscrupulous actors who will use their financial powers to short the market. This turns around profits to make the rich even richer. For those just starting in the crypto markets, this can be a risk because they have less money to lose before they can no longer afford to trade.

There is also the risk of impermanent loss

This is defined as a change to the prices of the tokens or coins deposited into the pool. It is called “impermanent” because the loss does not occur until the liquidity provider withdraws their assets to find that their coins are now worthless money. In this case, the loss then becomes permanent. The coins that are left in the pool still have the same owner, so leaving them where they are may correct this problem in the future.

The newness of decentralized finance

Because these are the days of the first adopters of Defi, it is similar to the Wild West. There are few rules to follow and it is every man for himself. The good news is that this same liberty is helping to make the beginning crypto user a bit wealthier. Learning the ins and outs of yield farming and becoming one who provides liquidity in a decentralized crypto market is a novel concept. For now, excellent returns can be had by jumping in and taking part. Taking a quick look at what others are reportedly making seems too good to be true. But that is how it usually goes with new technology.

The future of yield farming

The global blockchain investment industry is growing and is projected to grow at a rate of 69 percent CAGR (Compound Annual Growth Rate) until 2025. The cryptocurrency market as a whole is growing at a CAGR of 31 percent. This would seem to indicate that these early traders in the realm of yield farming are set to win for at least the next few years.