Solana (SOL), the Layer 1 token that has been making waves in the cryptocurrency market, has experienced an extraordinary surge since hitting a low of $8 in December 2022. The token has recorded gains of nearly 2,500%, and despite a slight slowdown at the start of the new year, it has resumed its upward trajectory, reaching new highs in March.

As the price has now broken above $200, there has been a surge in bullish on-chain activities, which might result in further price increases. However, traders are concerned about a potential short-term correction.

Over the last 24 hours, SOL price witnessed a total liquidation of over $18 million, with sellers liquidating around $12 million worth of short positions. As the SOL price now trades above $200, several key on-chain indicators have turned bullish, indicating a growing interest in the Solana network.

Total Fees and New Addresses Reach All-Time Highs

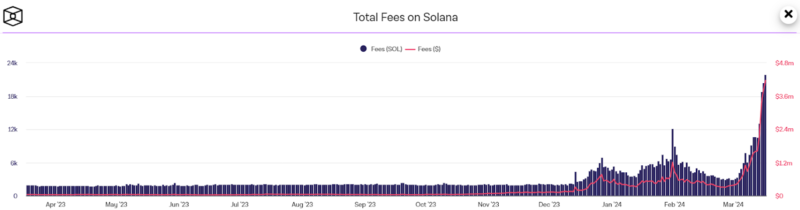

According to data, the total fees on Solana have been on the rise recently, with the metric touching an all-time high of $4.17 million. Solana, known for its high throughput and low transaction costs, has long been touted as a leading network in the race to overcome Ethereum’s scalability challenges. The recent surge in fees shows that traders are increasingly using the SOL network, helping the price to break through resistance channels.

Additionally, the number of new addresses has now touched an all-time high, surpassing the 1 million milestone. This increase in new addresses could lead to increased trading activity on the Solana network, potentially influencing its volatility.

Solana Ecosystem Thrives: Meme Coins and Growing Popularity

Apart from its price, nearly every aspect of Solana has seen significant growth, including the ecosystem, total value locked, trading volume, and user engagement. Notably, the platform’s meme coin sector has gained considerable attention, leading to the surge of tokens such as dogwifhat (WIF), Myro (MYRO), and Book of Meme (BOME).

Furthermore, Google Trends data indicates that interest in Solana has surpassed its previous peak in late 2021, reaching an all-time high of 100. This surge in popularity highlights the increasing competition for Solana as a strong contender to Ethereum.

Solana has experienced a significant upward trend over the last few days, reflecting strong demand at higher prices. The price of SOL surged toward $210; however, it faced rejection later and declined toward the $200 mark. As of writing, the SOL price trades at $201, surging over 5% from yesterday’s rate.

This surge has driven the Relative Strength Index (RSI) well into the overbought zone, indicating that the SOL/USDT trading pair might have surged too rapidly within a brief period. However, as the RSI has now declined, it has triggered a correction for the SOL price. Bears are currently aiming for a decline below the EMA20 trend line.

Should the price bounce back from the 20-day EMA, it would imply that market sentiment remains bullish and investors are seizing the opportunity to buy on dips. Such a scenario could further boost the chances of a surge above $210. However, this positive outlook could be invalidated if the price falls below the ascending support line.